FreshBooks and QuickBooks Online are accounting software solutions that take different approaches toward helping users with their business needs. While both software solutions support basic accounting functions, each one offers a few unique functions that the other does not. Read about the key features offered by FreshBooks and QuickBooks Online, so you can make an informed decision on the best tool for your business needs.

SEE: Feature comparison: Time tracking software and systems (TechRepublic Premium)

Jump to:

- FreshBooks vs. QuickBook Online: Feature comparison table

- FreshBooks and QuickBooks Online pricing

- Feature comparison: FreshBooks vs. QuickBooks Online

- Should your organization use FreshBooks or QuickBooks Online?

FreshBooks is an accounting and bookkeeping software with capabilities geared primarily toward small service-based businesses and freelancers. The cloud-based software solution includes accounting tools that help users with invoicing and managing expenses. FreshBooks also supports tasks that include time tracking, project management, automating payments and reporting.

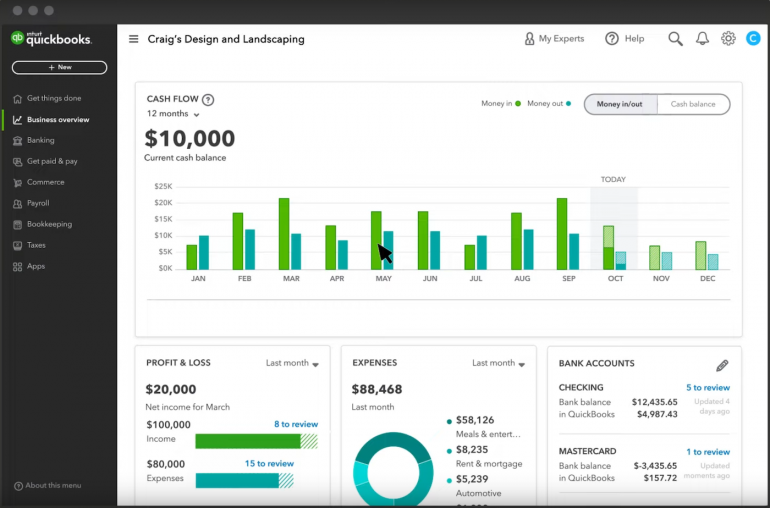

Intuit QuickBooks Online is a scalable accounting software solution with tools to help users manage their finances, bookkeeping and other business operations. It offers plans and products that are helpful for small and medium-sized businesses. QuickBooks Online’s accounting features benefit users with many of their processes for inventory, payroll, payments, taxes, time-tracking and e-commerce.

FreshBooks vs. QuickBooks: Feature comparison table

| Feature | FreshBooks | QuickBooks Online |

|---|---|---|

| Inventory management | No | Yes (not included with two cheapest plans) |

| Budgeting capabilities | No | Yes |

| Team roles included in all plans | Yes | No |

| Check printing and recording | No | Yes |

| Compare actual costs to estimates | Yes | No |

| Vendor management features | Yes | Yes |

| Time tracking included in all plans | Yes | No |

| Expense tracking included in all plans | Yes | Yes |

| User limits | Unlimited (additional fee per user) | Limited by plan |

| Scalability | Four plans | Four plans |

| Starting price | $15 per month | $35 per month |

FreshBooks and QuickBooks Online pricing

Based on the starting price alone, FreshBooks’ plans are cheaper than QuickBooks’ plans: FreshBooks starts at $15 a month while QuickBooks Online starts at $30 a month. You can also choose to pay for FreshBooks yearly instead of month to month and save an extra 10%. QuickBooks Online doesn’t offer a yearly payment option: All plans must be paid for monthly.

FreshBooks also offers more frequent sales with better discounts. Depending on the sale conditions, FreshBooks’ discounts can be as high as 90% off for six months. With QuickBooks Online, first-time buyers can choose between a 30-day free trial or getting 50% off for their first three months. QuickBooks only rarely offers deeper discounts.

However, FreshBooks’ accounting software quickly becomes more expensive than QuickBooks Online for businesses that have more than one person handling accounting software. Every additional user costs $10 a month on top of the base price, which means businesses that want to add two extra users to FreshBooks’ basic plan will pay $35 a month, not $15.

In contrast, Intuit QuickBooks limits users by plan. If you sign up for QuickBooks Online’s basic plan, only one user will have access. If you choose its most expensive plan, you can add up to 25 users.

Finally, QuickBooks Online includes free accountant access with each plan. FreshBooks includes free accountant access with every plan except its most basic, FreshBooks Lite.

FreshBooks’ pricing

- FreshBooks Lite includes five billable clients and costs $15 per month. Since it only supports five billable clients, it is a good option for freelancers and contractors.

- FreshBooks Plus includes 50 billable clients and is geared toward smaller businesses. It costs $30 per month.

- FreshBooks Premium costs $55 per month. This pricing plan includes unlimited billable clients and offers additional features like customizable email templates and the ability to send unlimited invoices. This plan is suitable for medium- to large-sized businesses.

- FreshBooks Select is a custom pricing option. It comes with additional perks, including onboarding services and a dedicated account manager. Large businesses and enterprises with greater numbers of employees would benefit most from this option.

FreshBooks’ pricing for additional users is $10 per person per month.

QuickBooks Online’s pricing

- QuickBooks Self-Employed is just $15 per month, with capabilities that are ideal for freelancers and independent contractors.

- QuickBooks Simple Start is $30 per month and provides basic features aimed toward small individually owned businesses and startups.

- QuickBooks Essentials is $55 per month and includes three users. This pricing plan is best for smaller businesses, as it makes it easy to pay contractors.

- QuickBooks Online Plus includes five users and costs $85 per month. It also comes with inventory tracking and can support medium-sized businesses.

- QuickBooks Online Advanced is $200 per month and can support up to 25 unique users and unlimited reports-only users, with additional features to support larger business operations.

QuickBooks Payroll is an add-on feature for business owners with employees. Users can choose between three payroll plans including QuickBooks Payroll Core for $45, Payroll Premium for $75 and Payroll Elite for $125. Each payroll plan also costs an additional fee per employee paid on top of the monthly base fee. Note that QuickBooks Payroll doesn’t support international payments, so if you work with global contractors, you should look for accounting software that integrates with global payroll solutions like Oyster or Papaya Global.

Feature comparison: FreshBooks vs. QuickBooks Online

Overview of FreshBooks’ key features

FreshBooks accounting software provides features for businesses with employees and solo entrepreneurs to manage their accounting and bookkeeping. With FreshBooks, users can invoice their customers and offer multiple payment options, pricing estimates and quotes. FreshBooks users can even set up automated payment reminders and scheduled late fees to ensure they receive appropriate compensation for their business.

Every FreshBooks plan except the cheapest uses the double-entry accounting system, which is a more accurate method of tracking finances and ensuring accurate records. The cheapest plan, which is geared toward freelancers who send no more than five invoices a month, relies on single-entry accounting. All of FreshBooks’ plans let users easily keep track of their business’s cash flow, profitability and tax information using the intuitive dashboards and reports features.

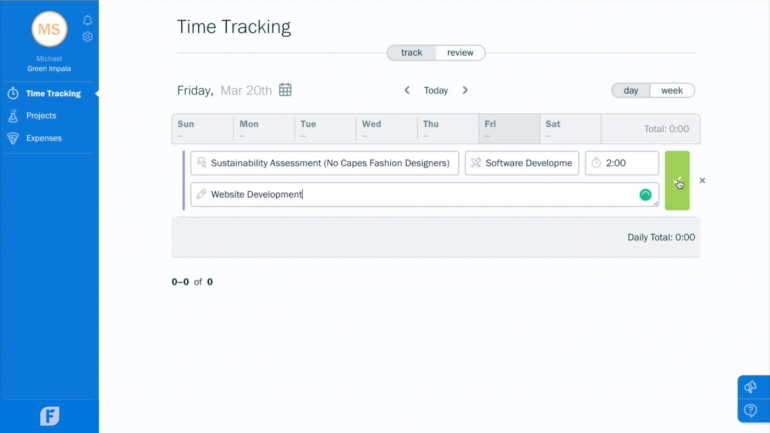

Users can develop invoices based on time logs that are automatically added from the FreshBooks Time Tracking system. The FreshBooks software also supports teams through its project management features, which keep business professionals, clients and contractors on track and working together with easy collaboration tools.

Overview of QuickBooks Online’s key features

QuickBooks’ features that are similar to FreshBooks’ features include expense tracking, online payment processing and credit card acceptance, report generation and cash-flow tracking. QuickBooks’ features with unique capabilities focus on tax processes, financial management and budgeting based on profitability.

Taxes are made simple through QuickBooks’ features, which can help your business calculate sales tax and prepare tax paperwork for contractors. In addition, the system provides tax deduction features, so users can organize tax documents and share information with accountants. Maintaining records of business travel with the mileage tracking feature makes it easy for users to generate reports and determine potential deductions.

In addition, QuickBooks Online has features to help users expand business opportunities. For instance, QuickBooks’ invoicing feature includes customizable templates and estimates. QuickBooks Online’s more expensive plans come with advanced features like inventory tracking, Excel-based business analytics, batched invoicing, automatic recurring invoices and employee expense tracking. While workflow automation is a feature, it is only provided on the QuickBooks advanced plan.

FreshBooks vs. QuickBooks Online: Ease of use

FreshBooks offers an intuitive user interface, making it simple to use and learn. In addition, FreshBooks’ users can quickly create invoices, track time and manage their business finances within one solution as well as access the system on the go through the mobile app.

FreshBooks software also simplifies the accounting and bookkeeping processes through integration with many commonly used third-party applications, including Gusto Payroll, HubSpot CRM, Acuity Scheduling and DocuSend.

Similarly, QuickBooks Online is designed to provide easy accounting functionality to a wide variety of users. The online software has a clean, intuitive interface to help users perform tasks without confusion and offers automated accounts payable processes to save time and improve accuracy. Still, this software’s advanced tax and expense features may be best for users with at least basic accounting knowledge.

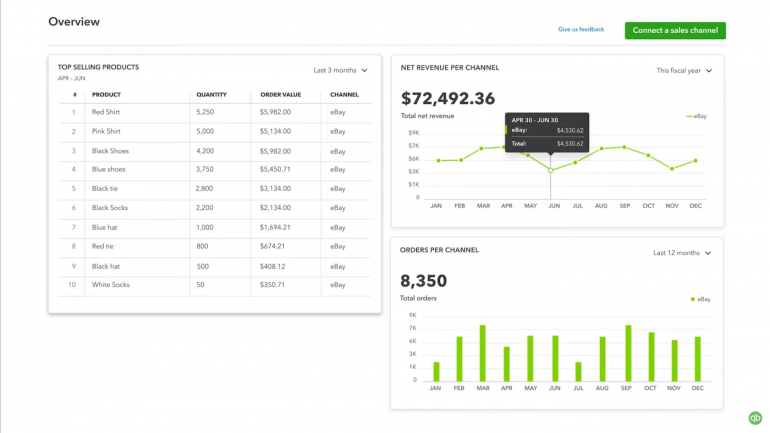

QuickBooks Online also helps users easily access data and increase the functionality of its services by providing connections to external systems and applications. Some popular integrations available include Amazon Business Purchases, Etsy, PayPal, and eBay. However, QuickBooks Online doesn’t sync with payroll providers like Gusto Payroll. Instead, it only syncs with Intuit QuickBooks’ payroll product, QuickBooks Payroll.

QuickBooks also helps users easily access data and increase the functionality of its services by providing connections to external systems and applications. Some popular integrations available include Amazon Business Purchases, Etsy, PayPal, and eBay.

FreshBooks vs. QuickBooks Online: Customer service, training, and software learning curve

If users are having trouble using this accounting system, they can visit the FreshBooks Support page to read up on different use scenarios and address commonly asked questions. The custom-priced plan also gives buyers a dedicated support number they can use to contact the company and receive help from the customer service team..

Plus, users can sign up for a free webinar with the FreshBooks expert team to learn the fundamentals of the accounting software service. In addition, the website lets users sign up for live and on-demand webinars on many subjects surrounding small business success with FreshBooks.

All QuickBooks Online plans include access to QuickBooks Support to answer their questions. Users with an Advanced membership plan can access online training courses and webinars to master the QuickBooks system and get the most out of its features; the free remote online training is valued at $3,000 and is accessible to the users and their entire team. Users who don’t have the Advanced membership plan can still participate in the QuickBooks training classes, but they will be required to pay for each course they take.

Should your organization choose FreshBooks or QuickBooks Online?

When choosing an accounting software system for your business, consider how each plan’s features would benefit your organizational processes. It can be helpful to start by identifying your organization’s most essential needs and then comparing each software option’s unique features to see how they would meet them.

For instance, say your company does a lot of business with numerous clients and is looking for an economical option to help them manage their invoices and collect payments. FreshBooks would be an ideal choice for their needs, as the premium plan includes unlimited billable clients at an affordable price.

On the other hand, a business with many suppliers would likely benefit from a system that can help simplify the process of tracking inventory and determining how many orders should be placed. QuickBooks would be the best option in this case because its Advanced plan includes inventory management features.

By identifying the needs of your organization’s ideal solution, you can assess the features and capabilities of each option to determine the best software based on how it will support your accounting experience.

Make sure to consider which third-party integrations you want as well. For instance, while FreshBooks integrates with most popular small-business payroll software, QuickBooks Online primarily integrates with QuickBooks Payroll. Apart from payroll, though, QuickBooks has more integrations than FreshBooks simply because it’s so popular worldwide. Check that your favorite business apps sync with your accounting software before you make a purchase.

By identifying the needs of your organization’s ideal solution, you can assess the features and capabilities of each option to determine the best software based on how it will support your accounting experience.