SurePayroll: Fast facts

| Starting price | $19.99 per month plus $4 per employee per month |

| Automated payroll | Yes |

| Direct deposit | Yes |

| Benefits administration | 401(k), health and workers' compensation coverage |

| Self-service employee portal | Yes |

| Native time tracking | No |

| Mobile app | Yes |

SurePayroll is an affordable payroll solution ideal for small businesses that want to simplify payroll processing. The software is owned by Paychex, an American software company offering HR, benefits, and outsourcing services. SurePayroll offers a self-service plan, a full-service plan and add-on options for integrations and tax filing. The mobile app has plenty of functionality, including the ability to run payroll. SurePayroll offers a decent set of payroll features, including the management of employee records. The recent improvement in the user interface has made navigation highly smooth for Windows and Mac users.

SurePayroll: Pricing

- Self-service plan: $19.99 per month plus $4 per employee per month.

- Full-service plan: $29.99 per month plus $5 per employee per month.

SurePayroll: Key features

Tax calculations

Small businesses often find it challenging to handle payroll taxes. SurePayroll helps simplify the process by automatically calculating the taxes and filing all the required payroll tax forms. Allowing software to do taxes helps minimize errors and saves time, so your HR team can focus on other tasks. SurePayroll also offers wage garnishment features, so you don’t have to manually calculate and deduct the withholding.

SEE: Learn about Papaya Global, including its key features, pros and cons and pricing.

Auto payroll

You can enter the payroll schedule, default hours, and salary amounts and SurePayroll will handle the rest. You don’t have to log in every time to run the payroll. SurePayroll can be configured to send you reminders a few days before the payroll is processed, just in case you need to make any changes. The auto payroll features ensure your employees get paid on time, every time. You also get a confirmation email once the payroll has been successfully processed. SurePayroll also allows you to automate deductions for 401(k), FSA and HSA funds.

Payroll reports

Payroll reports show details about payroll data such as total pay, taxes withheld and overtime incurred. It can also help in business audits, workers’ compensation claims and tax preparation. You get basic payroll reports with SurePayroll. While you don’t get to customize the reports, you get access to all the standard reports, such as payroll summary, employee earning records, taxable wages and workers’ compensation.

Creating employee records

It is common for businesses to update their employee roster or add new employees. However, it can use up a lot of time to enter employee records. The user interface of SurePayroll is designed to make it quick and easy to do so.

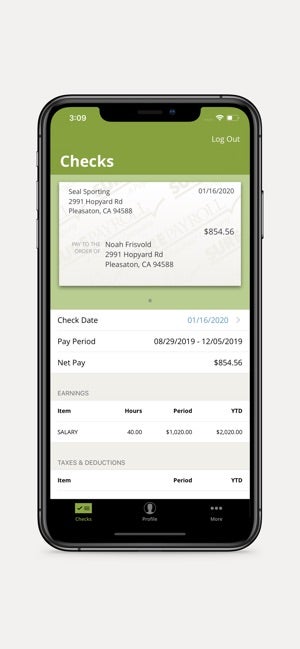

Mobile access

SurePayroll has an Android app and an iOS app. You can use these apps to run payroll remotely and get access to employee records, payroll reports and other payroll tools. You get an abbreviated dashboard view, so you won’t find all the information available in the desktop version, but it still has enough tools to be a handy feature.

SurePayroll: Pros

- Integration with numerous accounting software.

- Payroll processing through mobile apps.

- Customized pricing that is suitable for small businesses.

- Extended customer support hours, including weekends.

SurePayroll: Cons

- Limited reporting tools, such as lack of customization.

- Extra charges for managing 1099s and W2s.

- Extra charges for integrations and tax filing.

If SurePayroll isn’t ideal for you, check out these alternatives

SurePayroll is one of the leading payroll solutions for small businesses. However, it may not be a good fit for everyone. Here are a few top SurePayroll alternatives:

ADP

ADP is another excellent alternative to SurePayroll. If you want more features from your payroll solution, then ADP might be a good fit. You get access to tools for attendance tracking, hiring help and background checks with ADP. The higher-priced plans of ADP can also work for larger businesses and enterprises. ADP pricing starts at $29 per month, plus $5 per employee. You can read the full ADP review for more information.

Gusto

If your business needs a full-service payroll solution for small businesses, then you should consider Gusto. Pricing starts at $40 per month plus $6 per employee per month. The key differentiating factor between Gusto and SurePayroll is that you get better scalability with Gusto, making it a better fit for growing businesses. More details are available in the full Gusto review.

QuickBooks Payroll

If you already use QuickBooks products, their payroll solution would fit nicely into the ecosystem. With QuickBooks Payroll, you get features similar to SurePayroll, including a convenient mobile app, direct deposit and tax filing. However, the primary advantage of QuickBooks Payroll is that you get deep integration with other QuickBooks products. Pricing starts at $37.50 per month plus $5 per employee per month. You can read the full QuickBooks Payroll review for more information.

Review methodology

For this review of SurePayroll, we did a hands-on review of the software and gathered information from reputable websites that have SurePayroll reviews from customers. Our extensive research allowed us to analyze the SurePayroll features to determine the pros and cons of the software. We also looked at the pricing structure and top alternatives to complete a comprehensive software review.