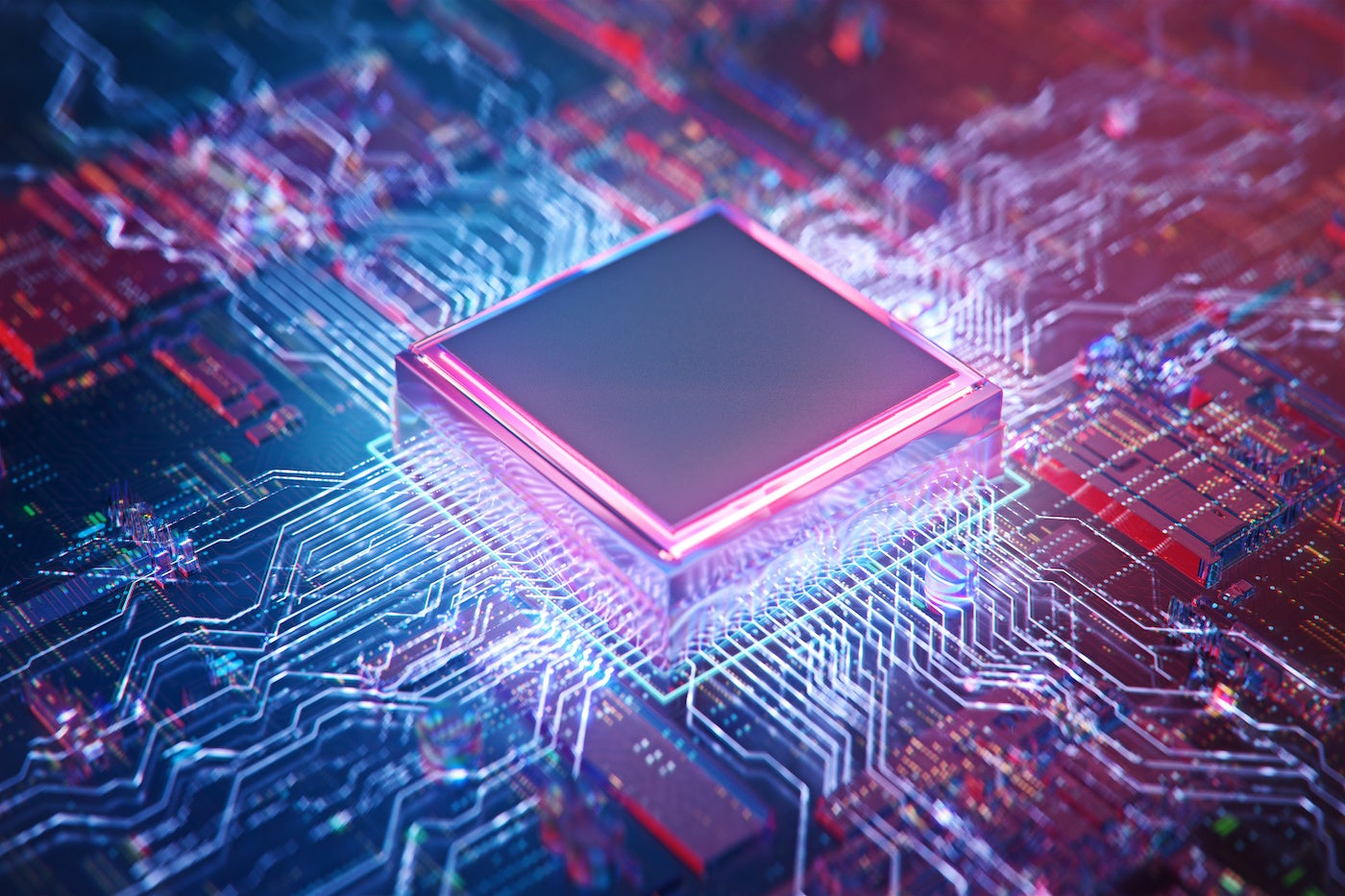

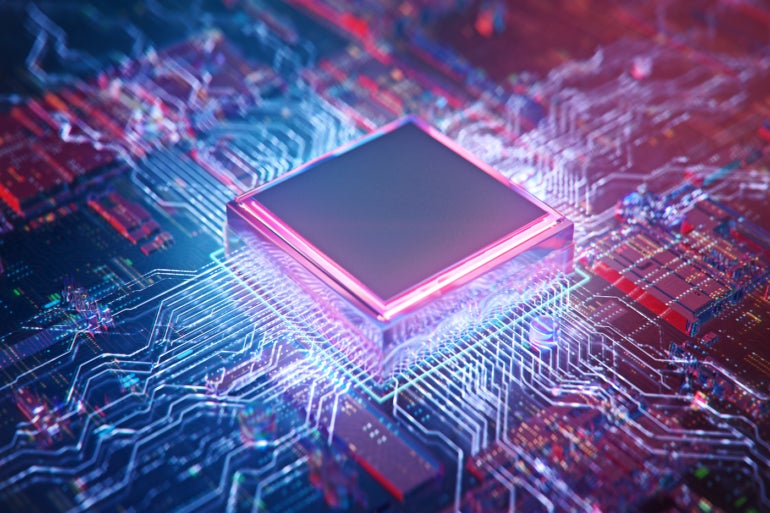

Chip manufacturing is undergoing a realignment as leading-edge semiconductor makers ponder moving more back-end assembly and testing onshore from the Asia/Pacific region. As Earth Day approaches, this raises questions about what semiconductors can do to reduce their carbon footprint.

A new report from Deloitte finds that the U.S. and Europe have set ambitious goals to grow their domestic chip manufacturing capacity. The U.S. intends to grow its domestic capacity share from 11% in 2020 to 30% in 2030, and Europe is aiming to expand its share from 9% to 20% over the same period, according to the report.

Because the global chip industry is expected to “roughly double in size’’ during this timeframe, “making these shifts requires semiconductor companies to consider certain nuances related to potential risks and challenges that they need to plan for’’ as they diversify, the report noted.

Jump to:

Building a sustainable semiconductor industry

The report finds that sustainability is one such challenge, because the chip industry “is likely contributing to climate change. The production process for every new generation of chips uses more energy, water and greenhouse gasses — especially process gasses with high global warming potential that are difficult to mitigate — than the generation before. And by 2030, the information and communications technology industry is likely to account for 20% of global electricity demand.”

Deloitte researchers observe that some semiconductors have been proactive in their sustainability efforts. For example, a couple of set net-zero targets are aiming to use more renewable energy to power their factories and office buildings, as well as minimize energy emissions from their supply chain operations. Some chip manufacturers and foundries have already implemented technologies that are enabling them to recycle and reuse water.

But not enough chip companies are focusing on sustainability. “Five semi companies with a combined market cap of more than $900 billion had not yet committed to net-zero targets until mid-2022,” the report said. “2023 could be the year when more of the large players set bold targets and take specific actions beyond the basic carbon offsets.”

Deloitte has worked with semiconductor manufacturers to help them select suitable climate and ESG disclosure standards, such as the Sustainability Accounting Standards Board and Global Reporting Initiative for disclosures and the Science-Based Targets initiative for decarbonization goal setting, said Brandon Kulik, a principal in Deloitte’s TMT Practice.

SEE: What is ESG, and how does it apply to my business?

The individual standards each company adopts are largely a matter of fit with the specific business, Kulik said. But there is no question that “emissions need to be reduced from both semiconductor corporations’ own direct operations, and increasingly, across the whole value chain, which requires collaboration with their supply chain partners,” he said.

Semiconductors can capture, recycle or reduce gasses

While water use and recycling have been greatly improved in the chip fabrication process, “there remain significant opportunities, especially in power use and the sourcing of renewable power — both for main supply and back up — as well as in the transition to less harmful chemical use,” Kulik said.

Specifically, he pointed to process gasses with high global warming potential in processes. “These process gasses can be captured, recycled, reduced or even replaced, although that will take time,” Kulik said. “Each of these will increasingly require fabricators to work together to influence things like the availability of renewable power and the scalability of new processes.”

In terms of the lifecycle emissions while their products are in use, there is still a great deal of innovation potential for semiconductors to reduce the power used by individual chips/circuits, he said.

“There is also a growing opportunity for chip designers and fabricators to work with their customers to design and manufacture complete circuits and products that are optimized for power efficiency, and over time recycling and circularity. In the case of data centers, for example, over a five- [to] 10-year period, there should be potential for chips to be optimized for new power distribution and cooling technologies.”

The Deloitte report states that 2023 will be a pivotal year for the chip industry, saying that companies this year “can form strategic alliances with all parts of the supply chain and work more cohesively to explore and develop new technologies and methods to help accelerate decarbonization efforts.” But the report adds there is skepticism that the industry can achieve net zero.

The report also suggests that semiconductor companies will “need to consider a more elaborate and comprehensive ESG and financial reporting mechanism.” These additional disclosures are vital because they could help provide increased operational transparency to local communities regarding what steps companies have taken to address environmental impact and how they are incorporating sustainable practices into their local manufacturing and office facilities, the report said.

“And they don’t have to settle for being victims of climate change, nor must they worsen it,” the Deloitte report stressed. “Instead, they can make 2023 an inflection to come together, define starting steps (including setting net-zero targets), and start contributing to the solution.”